Flood Insurance Quote

When it comes to protecting your home and belongings, flood insurance is an important component that can provide you with financial security and peace of mind in times of unexpected natural disasters. Floods can occur without warning, causing significant damage to your property, and repair and replacement costs can quickly add up. The right flood insurance coverage ensures that. That you are prepared for the unexpected and can recover more quickly after a flood event.

Coverage tailored to your needs

A flood insurance policy is designed to cover both The structure of your home and its contents Structural coverage includes protection for foundations, walls, floors, built-in appliances, and more. Contents coverage extends to items such as furniture, electronics, clothing, and other personal belongings that may be damaged in a flood. Exact coverage limits and premiums depend on factors such as your property's location, elevation, and flood risk zone.

Understanding flood-prone areas

Flood hazard areas are determined by the Federal Emergency Management Agency (FEMA) based on comprehensive floodplain maps. These zones range from high-risk areas to medium to low-risk areas known as Special Flood Hazard Areas (SFHAs). The level of risk associated with your property's location directly affects your insurance rates. High-risk areas generally have a greater chance of flooding and, as a result, higher insurance premiums.

National Flood Insurance Program (NFIP) and private options

The National Flood Insurance Program (NFIP) offers flood insurance coverage to homeowners, renters, and business owners. This program is supported by the federal government. Available in participating communities throughout the United States. NFIP policies have coverage limits for both residence and contents, with different options to suit different needs.

In recent years, the private flood insurance market has also grown, offering additional coverage options beyond what the NFIP offers. Private insurers may offer more flexible coverage limits and pricing based on individual risk assessment. It is important to compare both NFIP and private insurance options to determine the best fit for your situation.

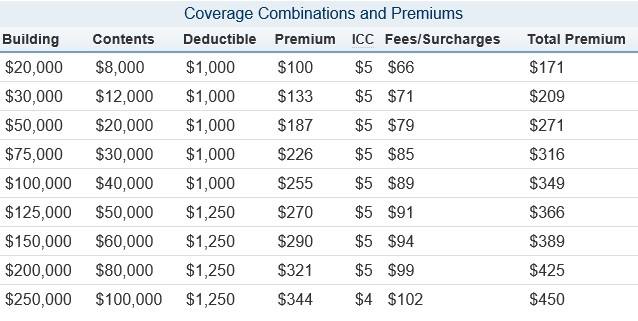

Calculation of premium

Several factors influence the cost of flood insurance premiums. These factors include the location of your property, the height of the lowest floor of your home, the age and construction of your home, and the coverage limits selected. High-risk areas usually come with higher premiums due to an increased likelihood of flooding. However, properties in moderate to low-risk areas can also experience flooding, making flood insurance a valuable investment for a wide range of homeowners.

take action

It is recommended to collect detailed information about your property. An insurance quote for flood protection tailored to your needs, including its location, construction, and height. This information will enable insurance providers to provide you with accurate premium estimates. Consulting with insurance agents who specialize in flood coverage can help you navigate the complexities of flood insurance and make an informed decision about the level of protection you need.

In conclusion, flood insurance assures you that your home and belongings are protected against the devastating effects of floods. As climate patterns continue to evolve, the risk of flooding is a concern for homeowners across the country. By investing in flood insurance, you are not only protecting your property but also securing your peace of mind in times of crisis. Don't wait until it's too late - take the proactive step of getting a flood insurance quote today and make sure you're prepared for whatever nature may bring.

No comments